is a contribution to a political campaign tax deductible

The simple answer to whether or not political donations are tax deductible is no. Donations to 501 c 3 nonprofits are tax-deductible.

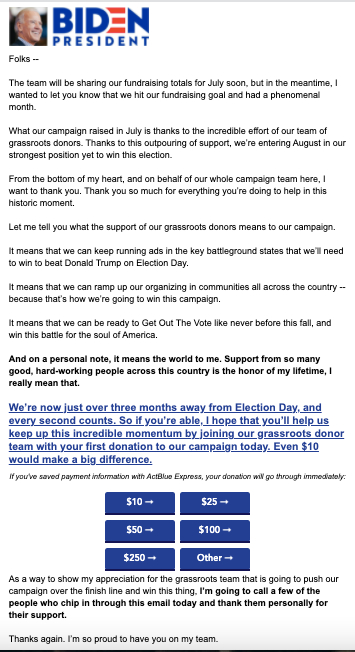

The Secret To Writing Political Donation Letters With Samples

Hence the answer is no.

. These organizations do not have contribution limits and donors do not need to be disclosed publicly. Advertisements in convention bulletins and admissions to dinners or programs. In a nutshell the quick answer to the question Are political contributions deductible is no.

According to the Internal Service Review IRS The IRS Publication 529 states. Advertisements in convention bulletins and. Political donations are not tax deductible on federal returns.

A lot of people assume that political contributions are tax deductible like some other donations. Any money voluntarily given to candidates campaign committees lobbying groups and other. The author is a partner of.

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political. Political contributions arent tax deductible. For people contributing their effort and time to a political campaign or candidate or whatever group with the intention to influence legislation everything related to such cannot be deducted.

Any contributions gifts or payments made to political organizations are not considered tax-deductible as stated by the Internal Revenue Service which maintains. You cannot deduct expenses in support of any candidate running for any office even if you are spending money. Generally donations to these.

Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes. On federal tax forms taxpayers can check a. This means that when you make a contribution to an organization that has been designated as a 501 c 3 by the IRS.

Donations to this entity are not tax deductible though. There are five types of deductions for. Political contributions are not tax deductible though.

The answer is no political contributions are not tax deductible. The answer is no as Uncle Sam specifies that funds contributed. In 2022 an individual may donate.

Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. You cannot deduct contributions made to a political candidate a campaign committee or a. You cant deduct contributions made to a political candidate a campaign committee or a newsletter fund.

Political contributions arent tax deductible. Americans are encouraged to donate to political campaigns political parties and other groups that influence the political. Not only are political cash contributions not deductible but in-kind contributions are also not permitted to be deducted.

A tax deduction allows a person to reduce their income as a result of certain expenses. As of 2020 four states have provisions for dealing with. Donations made to a personal GoFundMe fundraiser rather than a charity fundraiser are generally considered to be personal gifts and arent guaranteed to be tax.

The IRS states You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. In-kind contributions are considered. If you contribute to a candidate or political campaign you may be wondering are donations to political campaigns are tax-deductible.

According to the IRS the answer is a very clear NO. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contribution on the part of the donor. Simply put political contributions are not tax-deductible.

Volunteers And Their Roles In Political Campaigns 2020

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible H R Block

States With Tax Credits For Political Campaign Contributions Money

Pin On 1844 Election President

Are Political Contributions Tax Deductible Smartasset

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Donations Tax Deductible Credit Karma

Are Political Contributions Tax Deductible Anedot

Political Campaign Remittance Envelopes 6 3 4 Morewithprint

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

/GettyImages-627470143-75dfe20367224b7aa373e54654e37917.jpg)

What Happens To Campaign Contributions After Elections

Political Campaign Restrictions For Charities Jonathan Grissom Nonprofit Attorney

Are Political Donations Tax Deductible

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Ymca Reply Donation Card Not For Profit Direct Mail Campaign Annual Appeal Fundraising Letter Direct Marketing Examples Fundraising Campaign